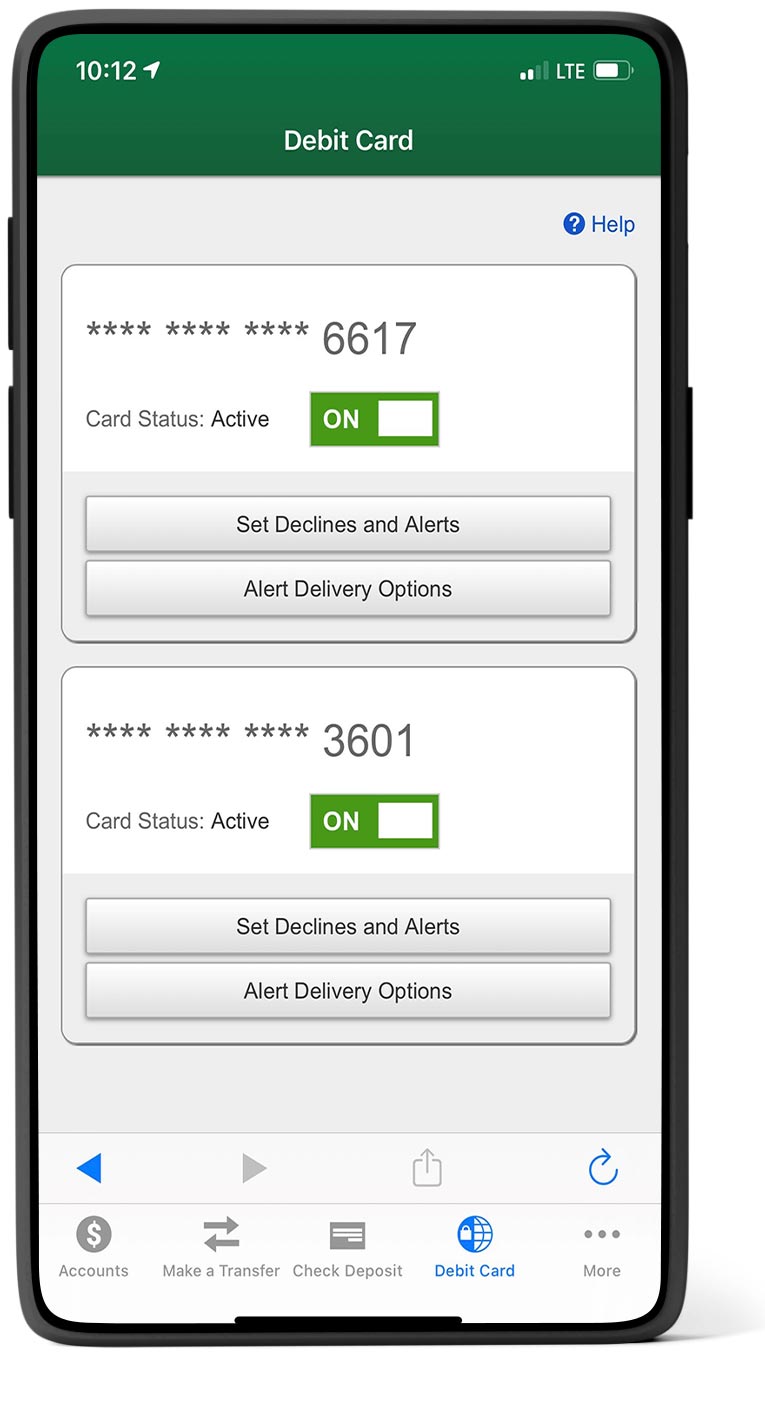

SecurLOCK is now embedded into our online banking app. So there’s no need to download a separate app.

Misplace your debit card? Use the “ON/OFF” feature to temporarily stop any transactions. When you recover it, just log back in and turn it back on, and your card will be ready to make purchases again. Best of all, it’s FREE to our customers.

With SecurLOCK you can:

- Turn your debit cards on/off

- Set Declines and Alerts

- Set alerts for all transactions, preferred transactions, and blocked transactions only

- Set by merchant type (personal care, restaurants, travel, age restricted, department stores, entertainment, gas stations, groceries, household, and others)

- Set by transaction type (In-store, online, mail/phone order, ATM, other)

- Set by location type (foreign transactions)

- Set by send limits (set by declines and alerts for certain dollar amounts at the clients request)

- Choose how you want to be notified of any activity:

- Push Notifications

- SMS Text Alerts

- Email Address

Personal Accounts